Fed Rate Cut Spurs Focus on Low-Beta Consumer Staples, Utility Stocks

The Facts -

- The Fed cut rates by 25 basis points to a 3.5%-3.75% target range.

- Low-beta stocks in Consumer Staples and Utilities sectors are now favored.

- The 2026 Fed policy remains uncertain with the upcoming leadership change.

In a move widely expected by financial markets, the Federal Reserve recently cut interest rates by 25 basis points, setting the federal funds rate to a new target range of 3.5% to 3.75%. This decision concludes the December meeting of the Federal Open Market Committee.

With the Federal Reserve's future actions on interest rates still unclear, investors are turning their attention to sectors characterized by lower volatility. Stocks in the Consumer Staples and Utilities sectors are currently in focus. Companies such as Monster Beverage MNST and Mama's Creations, Inc. MAMA are ranked #1 (Strong Buy) by Zacks, while Dominion Energy, Ameren Corporation AEE, and Sempra Energy SRE hold a Zacks Rank #2 (Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

These stocks are categorized as low-beta, with beta values between 0 and 1, indicating lower volatility compared to the broader market. They are also poised for earnings growth in 2026 and currently enjoy favorable Zacks rankings.

Anticipating Changes in Federal Reserve Leadership

Jerome Powell's tenure as chair of the Federal Reserve will conclude on May 15, 2026, paving the way for a new leader. Under Powell, the Federal Reserve has reduced interest rates three times in 2025 amid mixed signals related to inflation and unemployment. The upcoming leadership change has fueled speculation about the future direction of the Federal Reserve's policy.

The new chair's potential direction, whether maintaining the current rate-cutting strategy or adopting more aggressive cuts, remains to be seen. Critical determinants of the Federal Reserve's decisions will continue to include inflation, economic growth, consumer spending, and the labor market, influencing both policy formulation and timing.

Interest rates are particularly crucial in capital-intensive sectors like utilities, where lower rates can enhance profitability by reducing capital servicing costs, thereby improving company margins.

Advantages of Low-Beta Stocks During Uncertain Times

In the wake of the Federal Reserve's upcoming leadership change in 2026, market uncertainty is expected to remain heightened. During this transition period, it is unclear whether the new chair will maintain the current rate cut levels or pursue a different monetary policy approach.

Such uncertainty can lead to increased market volatility, especially affecting high-beta stocks that are more sensitive to interest rate fluctuations and economic expectations. Consequently, low-beta stocks may be considered a safer investment during these uncertain times.

Top Consumer Staples and Utilities Stocks with Potential

The Zacks Stock Screener identifies five promising stocks from the consumer staples and utilities sectors, each with a Zacks Rank of either #1 or #2 and a beta of less than 1. These stocks are anticipated to maintain strong performance into the next year.

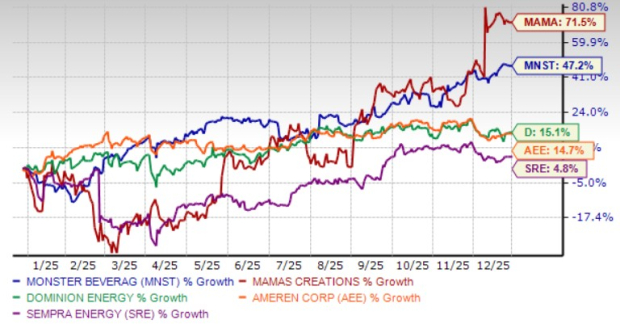

All the companies listed below have also recorded gains over the past year.

Performance Over the Past Year

Image Source: Zacks Investment Research

Monster Beverage, headquartered in Corona, CA, capitalizes on the growing global demand for energy drinks. Its solid brand portfolio and expanding international reach, combined with an asset-light model and consistent cash generation, support favorable earnings growth. The company holds a Zacks Rank #1.

Monster Beverage's beta is 0.48, and its long-term earnings growth is estimated at 16.81%. The Zacks Consensus Estimate for its 2026 earnings per share reflects a 5.14% increase over the last 60 days, with sales projected to grow to $9 billion, marking a 9.48% rise.

Mama’s Creations Inc., based in East Rutherford, NJ, specializes in fresh, Italian-inspired prepared foods available in major retail outlets. Its brand strength, expanding distribution, and the rising demand for convenient meals contribute to steady revenue growth and improved margins. Mama’s Creations has a Zacks Rank #1.

Mama’s Creations features a beta of 0.79, with 2026 earnings per share estimated to rise by 4.35% over the past 60 days. Sales are forecasted to reach $218.2 million, indicating a 26.49% increase.

Dominion Energy, located in Richmond, VA, provides regulated electric and natural gas utilities, ensuring predictable, rate-based earnings. Its focus on grid updates, renewable generation, and stable cash flows ensures reliable dividends and long-term growth. The company holds a Zacks Rank #2.

Dominion Energy's beta is 0.70, and its long-term earnings growth is pegged at 10.26%. Its current dividend yield is 4.51%, surpassing the Zacks S&P 500 Composite’s yield of 1.4%. The Zacks Consensus Estimate for 2026 earnings per share shows a 0.28% increase in the past 60 days, with sales anticipated to grow by 5.14% to $16.48 billion.

Ameren Corporation, based in St. Louis, MO, operates regulated electric and gas utilities throughout the Midwest. Its substantial capital investment plan, favorable regulatory environment, and emphasis on clean energy infrastructure drive predictable earnings growth. Ameren holds a Zacks Rank #2.

Ameren’s beta is 0.57, with a long-term earnings growth projected at 8.52%. Its current dividend yield is 2.85%. The Zacks Consensus Estimate for 2026 earnings per share shows a 0.56% increase over the past 60 days, with sales expected to rise by 6.33% to $9.71 billion.

Sempra Energy, based in San Diego, CA, operates regulated electric and natural gas utilities in the U.S. and Mexico. Its diverse asset base and long-term infrastructure investments, alongside constructive regulation, provide stable cash flows and reliable dividends. Sempra holds a Zacks Rank #2.

Sempra’s beta is 0.73, with long-term earnings growth estimated at 7.33%. Its current dividend yield is 2.91%. The Zacks Consensus Estimate for 2026 earnings per share reflects a 0.39% increase over the past 60 days, with sales projected to grow by 8.5% to $14.74 billion.

Zacks Highlights Top 10 Stocks for 2026

Looking for investment opportunities for 2026? The Zacks Top 10 Stocks list could offer significant potential based on historical trends.

Since 2012, under the guidance of Director of Research Sheraz Mian, the Zacks Top 10 Stocks have achieved gains of +2,530.8%, far surpassing the S&P 500’s +570.3% rise.

Sheraz is now evaluating 4,400 companies to select the top 10 stocks for 2026. The selections will be available on January 5, offering a unique investment opportunity.

Be First to New Top 10 Stocks >>

Ameren Corporation (AEE) : Free Stock Analysis Report

Sempra Energy (SRE) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Mama's Creations, Inc. (MAMA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

---

Read More USA Works News